Biggest Crypto Narrative For 2026?

The phrase “debasement trade” as a crypto narrative has become popular. It’s this idea of getting out of government-backed assets, such as bonds or fiat currencies, and into “hard” assets like gold or Bitcoin.

Bitwise CIO Matt Hougan recently posted on X that the debasement trade theory is gaining steam and will be popular into 2026. So, what is this theory, and why is it gaining traction now?

What is the Debasement Trade Theory in Bitcoin

The Debasement Trade theory in Bitcoin refers to investors buying Bitcoin as protection against the declining value of fiat currencies.

Sponsored

Sponsored

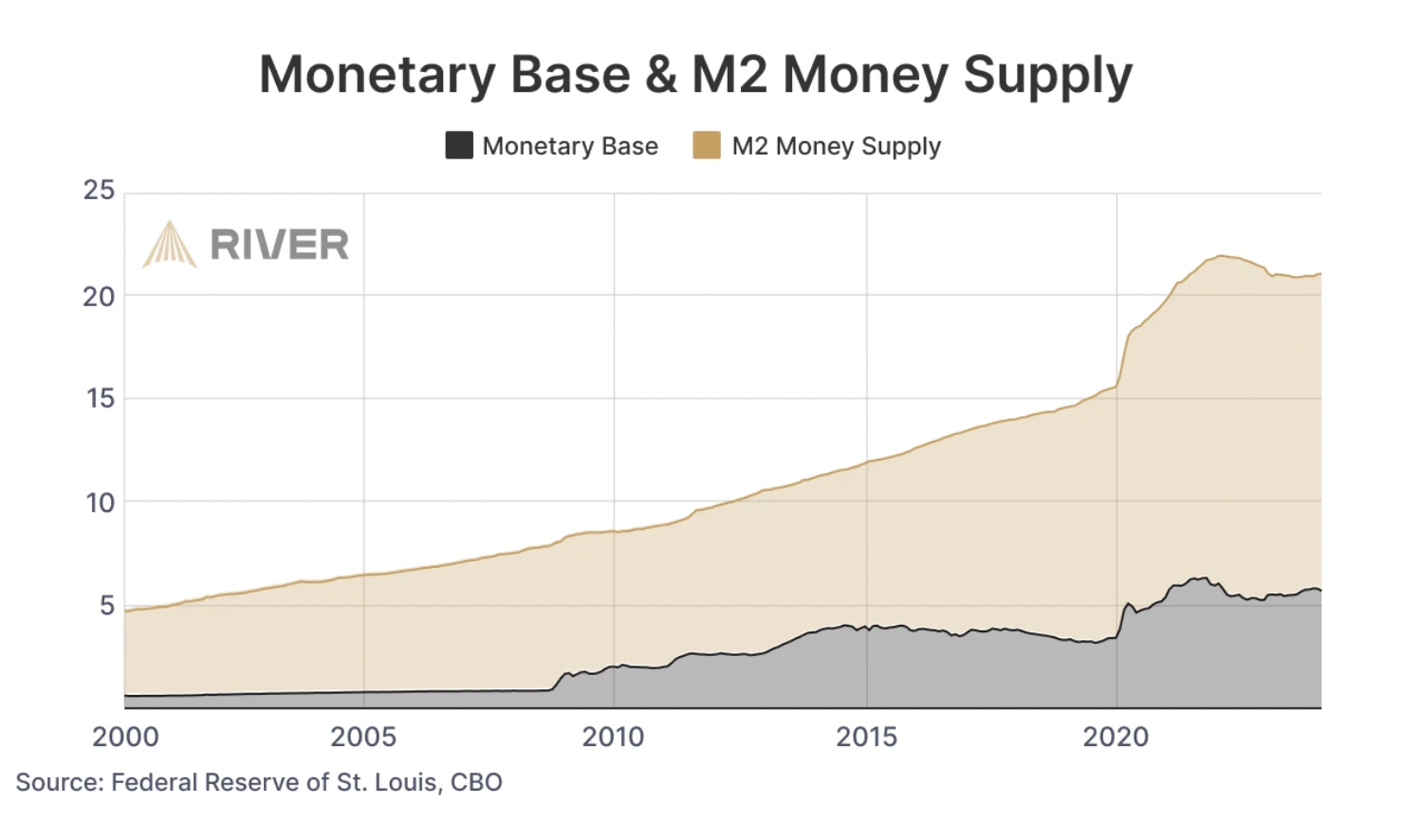

As governments expand money supply through debt and monetary stimulus, each unit of currency loses purchasing power. This process is known as currency debasement.

Bitcoin’s fixed supply of 21 million coins and independence from central banks make it an attractive hedge against this erosion.

In this view, Bitcoin functions as a “digital hard asset,” similar to gold. It preserves value when trust in traditional money weakens.

The trade has gained momentum as global debt rises and inflation concerns persist. It allows investors to treat Bitcoin as part of a broader strategy to safeguard wealth from monetary dilution.

Increasing Uncertainty

Satoshi Nakamoto created Bitcoin as a response to the 2008 financial crisis. Its genesis block, when the network first went live in 2009, contained a message referencing bank bailouts.

So there’s really no question, despite the mystery surrounding Bitcoin’s founders, that the cryptocurrency was created as a salve for traditional financial chaos.

“I think that BTC’s fundamental thesis was always some variation of the debasement trade,” said Andrew Tu, an executive at crypto market maker Efficient Frontier. “Starting from the genesis block in which Satoshi references the bailout for banks.”

Sponsored

Sponsored

The financial markets overall seem to be very reactionary to US policy. That’s why the market seems to change abruptly or on a whim with the Trump administration.

The latest October 10 market crash due to tariff fears is an example of this. Although recovery was almost as swift.

In fact, zooming out, the price of Bitcoin has risen 50% over the past year, despite market choppiness from week to week.

Debasement Bullish or Bearish for Crypto Traders?

The term “debasement” sounds serious, something that should be a concern for market participants.

However, the term may be more of a story to tell for gyrating markets, often at the whim of US policymakers or other global events.

Sponsored

Sponsored

Those studying the markets daily may have a different opinion on debasement, pulling in bearish sentiment overall.

“Despite all of the uncertainty and economists saying a recession and/or bear market was extremely likely in 2023, most likely in 2024, and 50/50 in 2025,” noted Jeff Emrby, Managing Partner of Globe 3 Capital. “It’s too early to call right now, but we are expecting to call for another bull market year in 2026.”

If the debasement trade idea becomes something lots of people talk about in 2026, as Bitwise’s Hougan predicts, those who have believed in Bitcoin for a long time won’t be surprised.

This used to be called being “libertarian” or a “cypherpunk.” It wasn’t necessarily in vogue at the time, and was part of Bitcoin’s counterculture vibe up until around 2016. It might be in vogue now.

“It’s pretty much the very foundation of the Bitcoin value story,” said Witold Smieszek, Director of Investments for Paramount Digital. “So in that way it’s nothing new for the old guard who got into crypto through a mix of economics and cypherpunk values.”

Bitcoin Rotation

Potential crypto investors have many more options in front of them versus the cypherpunk days when only Bitcoin was available.

Sponsored

Sponsored

The prevalence of Layer-1s and more favorable regulations has led to corporations expressing interest in various chains, which could result in significant value increases for those underlying tokens.

But it’s likely Bitcoin that fits the debasement story best.

“BTC with its hard supply cap has always been seen by Bitcoiners as a hedge against the fiat system that we currently have,” said Efficient Frontier’s Tu.

Since the 2020 pandemic-era money printing, the total M2 money supply, which is cash and its equivalents, jumped from around $15 trillion to over $20 trillion.

Cheap and easy money has led to rotation into Bitcoin and a higher price – BTC was as low as $4,000 during the 2020 lockdowns. But that doesn’t mean there won’t be a rotation out in the face of other macro events.

Volatility might not always seem fun for inexperienced crypto holders, but it’s really good for traders, with daily Bitcoin volume across exchanges at $17 billion, per data aggregator Newhedge.

“If the market crashes because the AI bubble pops or something, then we will probably still see the BTC and overall crypto market, and probably gold in the short-term before outperformance in the medium-term, crash as well,” added Andrew Tu from Efficient Frontier