How Hidden Geopolitical Factors are Shocking Bitcoin Markets

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in—markets are shifting, fear is rising, and Bitcoin is dancing to a tense global rhythm. From geopolitical sparks to shadowy traders making millions, the pioneer crypto is on edge, teetering between consolidation and sudden, dramatic moves.

Crypto News of the Day: Geopolitical Tensions and Market Fear Shake Bitcoin

Bitcoin dropped sharply ahead of the US market open on Tuesday, extending a volatile start to 2026 amid geopolitical and macroeconomic concerns.

Sponsored

Sponsored

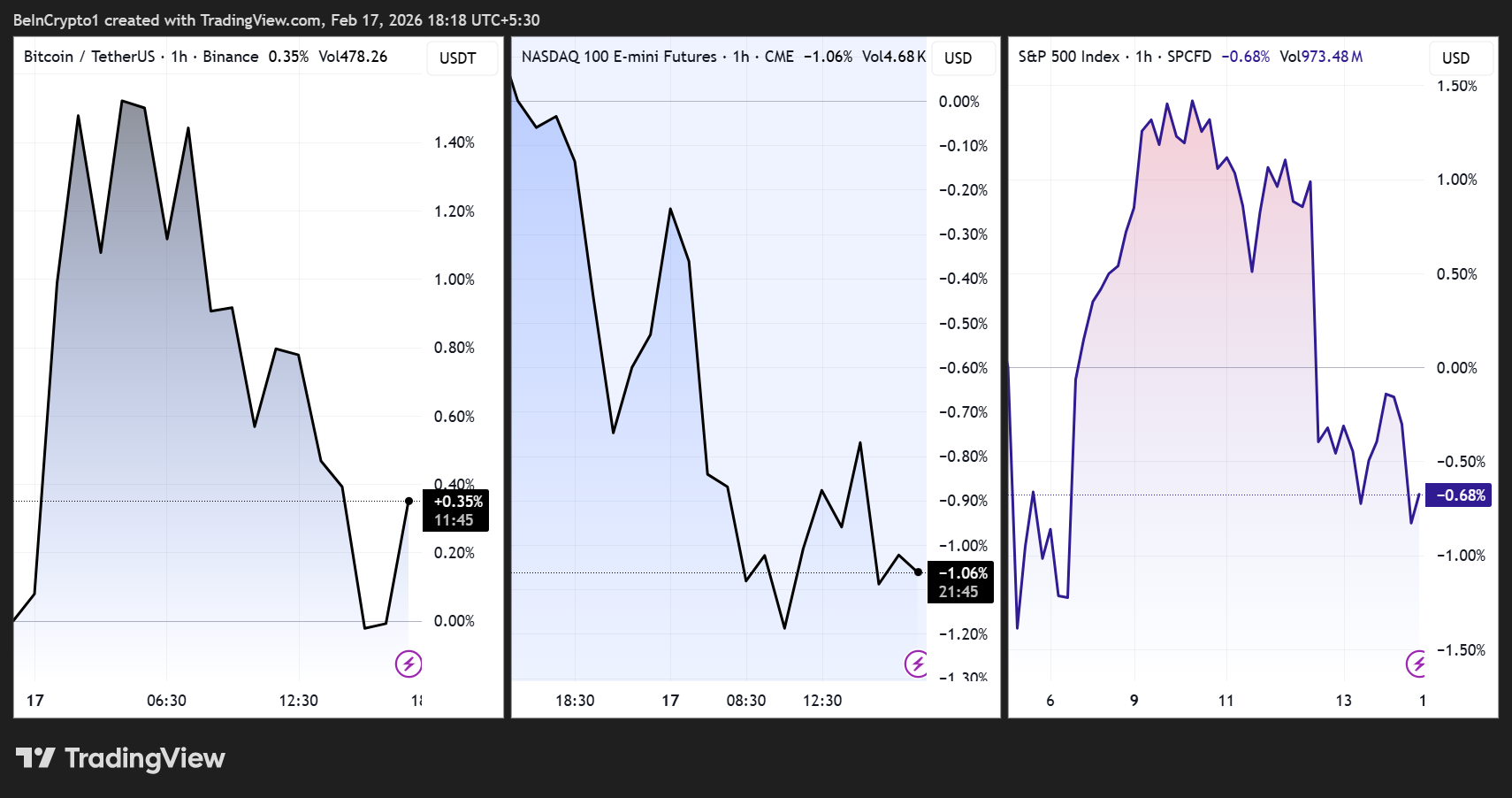

The pioneer crypto fell 1.7% to roughly $67,600, mirroring weakness in equity futures. The Nasdaq 100 contracts fell 0.9% while the S&P 500 contracts dropped 0.6%, signaling a softer start on Wall Street.

Bitcoin’s correlation with high-beta tech stocks has strengthened in recent months, making the pioneer crypto increasingly sensitive to risk-off sentiment in equities.

“Investors are turning cautious amid rising tensions around Iran, fresh debate over AI’s broader economic impact, and uncertainty over Federal Reserve rate cuts after recent inflation data,” reported Walter Bloomberg on X.

The macro backdrop has contributed to sustained outflows from US-listed Bitcoin ETFs. Last week alone, investors withdrew $360 million, marking the fourth consecutive week of net outflows.

The combination of geopolitical uncertainty, ETF withdrawals, and leverage unwinds has pushed Bitcoin down by more than 50% from its October 2025 peak of $126,000.

“Analysts now view $60,000 as key near-term support, while further macro shocks could see prices revisit the $50,000 range,” Walter added.

It aligns with a recent Galaxy Digital projection, in which head of research Alex Thorn estimated Bitcoin drifting toward the 200-week average near $58,000.

Sponsored

Sponsored

Meanwhile, market sentiment is at levels not seen since the depths of the 2022 bear market, with only 55% of Bitcoin’s supply currently in profit and roughly 10 million BTC held at a loss.

Elsewhere, CryptoQuant’s Fear and Greed Index suggests extreme caution, at 10, firmly in the “extreme fear” zone.

Shadow Shorts and Safe-Haven Bets Highlight Crypto’s Risk-Off Mood

Adding to the market’s nervous undertone is the presence of aggressive short positions. Reports indicate that a not-so-popular trader has made $7 million by shorting multiple crypto assets, including $3.7 million on Ethereum and $1.45 million on ENA.

Sponsored

Sponsored

While largely anonymous, this trader exemplifies the growing sophistication and audacity of market participants betting on downside risk.

Meanwhile, broader investor behavior also reflects a flight toward perceived safety. The February global fund manager survey from Bank of America (BofA) highlighted gold as the most crowded trade, with 50% of managers holding long positions, while top US tech stocks (Nvidia, Alphabet, Apple, Amazon, Microsoft, Meta, and Tesla) ranked second, cited by 20% of respondents.

This preference for traditional hedges reflects heightened risk aversion in financial markets. Despite the current turbulence, investors should not act in panic. Bitcoin’s history suggests it often consolidates after sharp pullbacks before resuming longer-term trends.

However, the combination of geopolitical flashpoints, ETF outflows, concentrated shorting activity, and extreme fear readings suggests that market volatility may persist in the near term.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today: